All Categories

Featured

Table of Contents

This is only advised in case where the death advantage is very essential to the plan owner. The added expense of insurance for the improved coverage will minimize the money value, hence not ideal under boundless financial where cash money value dictates just how much one can borrow (Cash flow banking). It's important to note that the accessibility of reward options might vary depending upon the insurance provider and the specific plan

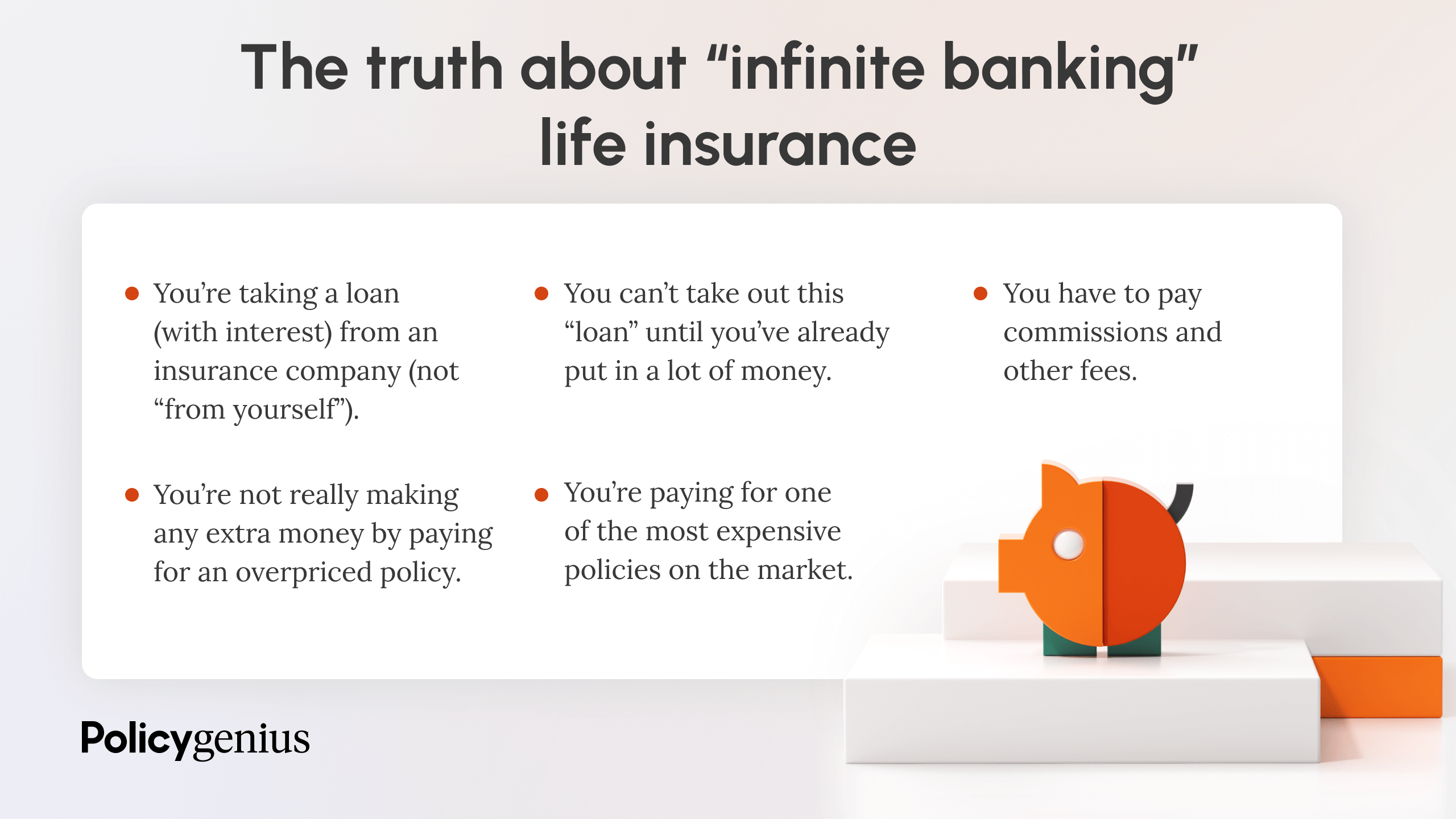

There are wonderful advantages for unlimited banking, there are some points that you should think about prior to obtaining right into limitless financial. There are additionally some disadvantages to limitless financial and it may not be suitable for somebody who is seeking economical term life insurance policy, or if a person is looking right into buying life insurance policy entirely to safeguard their family in case of their death.

It is essential to recognize both the benefits and constraints of this monetary approach prior to making a decision if it's best for you. Complexity: Infinite banking can be complicated, and it is very important to recognize the details of just how an entire life insurance policy policy jobs and exactly how policy lendings are structured. It is very important to properly set-up the life insurance coverage plan to enhance limitless financial to its full potential.

How can Self-banking System reduce my reliance on banks?

This can be particularly problematic for individuals who rely upon the survivor benefit to offer their liked ones. In general, limitless banking can be a valuable monetary technique for those who understand the details of just how it functions and are eager to accept the prices and constraints related to this investment.

Choose the "riches" choice instead of the "estate" choice. The majority of business have 2 various kinds of Whole Life strategies. Choose the one with higher money worths previously on. Throughout a number of years, you add a considerable amount of money to the plan to develop the cash money worth.

You're essentially lending cash to yourself, and you settle the lending gradually, frequently with rate of interest. As you pay back the car loan, the cash money value of the plan is renewed, enabling you to obtain against it again in the future. Upon fatality, the death benefit is decreased by any kind of outstanding loans, however any type of continuing to be fatality benefit is paid tax-free to the recipients.

How does Privatized Banking System compare to traditional investment strategies?

Time Horizon Threat: If the insurance holder chooses to cancel the policy early, the cash abandonment worths may be considerably reduced than later years of the policy. It is advisable that when exploring this strategy that has a mid to long-term time horizon. Tax: The insurance policy holder may incur tax effects on the fundings, dividends, and fatality advantage repayments obtained from the plan.

Intricacy: Limitless banking can be intricate, and it is essential to understand the details of the plan and the cash money buildup component before making any investment decisions. Infinite Banking in Canada is a genuine financial method, not a rip-off - Infinite Banking concept. Infinite Banking is a principle that was created by Nelson Nash in the United States, and it has considering that been adjusted and applied by monetary experts in Canada and other countries

Is Whole Life For Infinite Banking a better option than saving accounts?

Plan lendings or withdrawals that do not go beyond the adjusted cost basis of the plan are taken into consideration to be tax-free. If plan finances or withdrawals go beyond the adjusted expense basis, the excess amount might be subject to taxes. It is very important to note that the tax advantages of Infinite Banking may undergo transform based upon modifications to tax laws and laws in Canada.

The dangers of Infinite Financial include the potential for plan finances to reduce the survivor benefit of the policy and the possibility that the plan may not execute as anticipated. Infinite Financial may not be the very best strategy for everybody. It is essential to meticulously consider the expenses and possible returns of taking part in an Infinite Banking program, as well as to thoroughly research study and understand the associated risks.

Infinite Financial is different from standard financial in that it permits the insurance holder to be their own source of funding, rather than relying upon standard financial institutions or lenders. The policyholder can access the money value of the policy and use it to finance purchases or investments, without having to go via a conventional lender.

Is there a way to automate Wealth Building With Infinite Banking transactions?

When many people need a car loan, they apply for a line of credit history with a typical financial institution and pay that lending back, over time, with interest. For medical professionals and other high-income earners, this is possible to do with unlimited financial.

Right here's an economic consultant's evaluation of boundless financial and all the advantages and disadvantages included. Unlimited financial is an individual banking approach established by R. Nelson Nash. In his publication Becoming Your Own Banker, Nash discusses exactly how you can make use of a long-term life insurance coverage plan that constructs cash worth and pays rewards hence freeing on your own from needing to obtain money from lending institutions and pay back high-interest loans.

And while not everybody gets on board with the concept, it has actually tested numerous thousands of individuals to reconsider just how they bank and exactly how they take fundings. Between 2000 and 2008, Nash released six editions of the book. To this day, economic consultants consider, method, and debate the idea of infinite banking.

What is Infinite Banking Retirement Strategy?

The boundless banking concept (or IBC) is a bit extra challenging than that. The basis of the unlimited banking principle starts with long-term life insurance policy. Infinite banking is not feasible with a term life insurance coverage plan; you should have a permanent cash money value life insurance policy. For the concept to function, you'll require among the following: an entire life insurance policy plan a universal life insurance policy plan a variable global life insurance plan an indexed universal life insurance policy If you pay more than the required regular monthly costs with long-term life insurance policy, the excess payments build up cash money value in a money account.

With a dividend-paying life insurance coverage plan, you can grow your cash money value even quicker. Suppose you have a long-term life insurance plan with a common insurance coverage firm.

Latest Posts

Be Your Own Bank - Infinite Growth Plan

Becoming Your Own Banker : The Infinite Banking Concept ...

Banking Concepts