All Categories

Featured

Table of Contents

You after that get the auto with cash money. Self-banking system. The debate made in the LIFE180 video clip is that you never ever obtain anywhere with a sinking fund. You diminish the fund when you pay cash money for the vehicle and renew the sinking fund only to the previous level. That is a huge misunderstanding of the sinking fund! The cash in a sinking fund makes rate of interest.

That is exactly how you stay on top of rising cost of living. The sinking fund is constantly expanding using rate of interest from the conserving account or from your vehicle repayments to your automobile sinking fund. It likewise occurs to be what infinite banking comfortably forgets for the sinking fund and has exceptional recall when related to their life insurance coverage product.

Well, I'm not calling any person a phony. I am calling the mathematics right into concern, nonetheless. In the video clip we hear our first thrilled boast. See the $22,097 highlighted? That, we are informed, is the increase in our money worth in year two. Allow's dig a bit below. The real boast need to be that you contributed $220,000 to the limitless financial policy and still only have a Cash money Worth of $207,728, a loss of $12,272 approximately this point

The $22,097 highlighted in the video clip originates from the "Non-Guaranteed" columns. The "Guaranteed" amount is less. Aaaaaand. You still have a loss regardless what column of the estimate you utilize. Of training course you can "obtain" some of your own cash if you want. Much more on that particular later on. Wealth management with Infinite Banking. Initially we require to speak about.

Now we turn to the longer term price of return with limitless banking. Before we disclose the real long-term price of return in the whole life plan estimate of a marketer of infinite financial, allow's consider the concept of linking a lot money up in what in the video clip is called an interest-bearing account.

The only means to turn this right into a win is to make use of malfunctioning mathematics. First, review the future worth calculator listed below - Policy loans. (You can utilize a range of various other calculators to get the same outcomes.) After 10 years you take care of a little bit much more than a 2% yearly rate of return.

What are the risks of using Infinite Banking Benefits?

The concept is to obtain you to believe you can gain cash on the cash obtained from your limitless banking account while all at once gathering a revenue on various other financial investments with the exact same cash. Which leads us to the next achilles' heel. When you take a lending from your whole life insurance policy policy what really occurred? The money worth is a contractual pledge.

The "effectively structured entire life plan" bandied around by vendors of limitless financial is truly just a life insurance coverage business that is possessed by insurance holders and pays a dividend. The only factor they pay a dividend (the passion your cash worth makes while obtained out) is since they overcharged you for the life insurance policy.

Each insurance policy company is various so my example is not an excellent match to all "correctly structured" boundless banking instances. THIS IS AN ADDED FUNDING OF YOUR INFINITE FINANCIAL ACCOUNT AND NOT EXPOSED IN THE IMAGE!

How does Infinite Banking For Retirement create financial independence?

Even if the insurance provider credited your cash money worth for 100% of the interest you are paying on the financing, you are still not getting a cost-free adventure. Life insurance loans. YOU are spending for the interest attributed to your cash worth for the amounts loaned out! Yes, each insurer whole life plan "appropriately structured" for limitless banking will certainly vary

Right here is one nightmare limitless financial supporters never ever intend to talk regarding. When you pass away, what occurs with your whole life insurance policy plan? Your recipients obtain the survivor benefit, as promised in the contract between you and the insurer. Wonderful! What takes place to the cash worth? The insurance provider keeps it! Keep in mind when I stated the lending from your cash money value originates from the insurer basic fund? Well, that is due to the fact that the cash money worth belongs to the insurer.

I might go on, yet you understand. There are lots of deadly flaws to the infinite financial concept. Life insurance companies and insurance coverage representatives love the principle and have adequate factor to be callous the fatal flaws. In the long run there are just a couple of factors for utilizing irreversible life insurance policy and infinite banking is not one of them, despite how "effectively" you structure the plan.

This in no way implies you need to go into financial debt so you can use this strategy. The following technique is a variation of this approach where no debt is necessary. The only reason I begin with this strategy is since it can produce a larger return for some people and it also assists you "obtain out of financial obligation much faster." Below is exactly how this method works: You will require a home mortgage and credit line.

Infinite Banking Cash Flow

Your regular home mortgage is currently paid for a little bit extra than it would certainly have been. As opposed to maintaining more than a token amount in your bank account to pay expenses you will drop the money right into the LOC. You now pay no passion because that quantity is no much longer borrowed.

Your price of return on your everyday float is the interest rate on the mortgage. If your LOC has a greater rates of interest than your home loan this technique encounters troubles. When passion rates were really reduced for a decade this technique worked better. If your mortgage has a greater rate you can still use this technique as long as the LOC passion price is comparable or less than your home mortgage passion price.

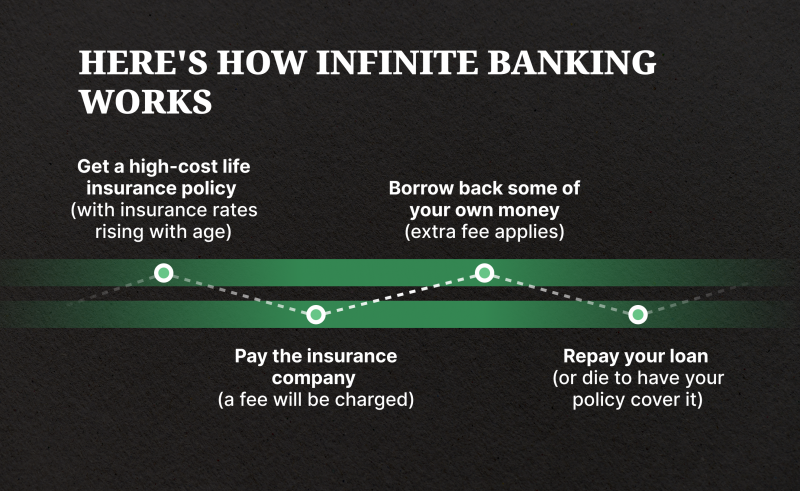

Infinite banking, as advertised by insurance representatives, is designed as a large financial savings account you can obtain from. As we saw above, the insurance business is not the warm, unclear entity handing out cost-free money.

If you remove the insurer and spend the very same monies you will certainly have more since you do not have intermediaries to pay. And the rates of interest paid is most likely higher, relying on existing rates of interest. With this in mind, Treasury Direct is an excellent tool for constructing wide range with your excess funds earmarked for cost savings and no state earnings taxes.

How secure is my money with Infinite Banking Cash Flow?

You can withdraw your cash at any moment. You can constantly call it obtaining your own cash if you want. The very same idea collaborates with cash markets accounts at banks (banks or credit rating unions). Right here is the magic of limitless financial. When you borrow your very own money you additionally pay on your own a rate of interest.

Latest Posts

Be Your Own Bank - Infinite Growth Plan

Becoming Your Own Banker : The Infinite Banking Concept ...

Banking Concepts